Investments

The National Insurance Board of Trinidad and Tobago (NIBTT) is continuously working to achieve the highest available returns within our investment policy for the benefit of our customers. Income earned from our investments together with contribution income are used to provide coverage for our insured population.

Investment Income

The NIBTT’s investment portfolio as at June 30, 2020 had a market value of $27.73 billion, reflecting a 0.44% or $122 million decrease over the fund size as at June 30, 2019 which stood at $27.85 billion. The decrease in the Fund’s market value was mainly attributable to approximately $120 million in unrealised losses; the equity and fixed income portfolios accounting for $10 million and $87 million respectively of these unrealised losses. The worldwide pandemic has significantly affected global markets, as equities in particular have experienced the steepest declines since the global financial crisis. As such, the NIBTT’s net investment yield experienced a decline from 8.08% in FY2019 to 4.38% in FY2020. The decrease in the NIBTT’s portfolio was further impacted by withdrawals of $950 million from the Investments Cash Account to support system shortfall. During the financial year, the NIBTT maintained its significant equity holdings in top locally listed companies as well as continued participation in the local debt market.

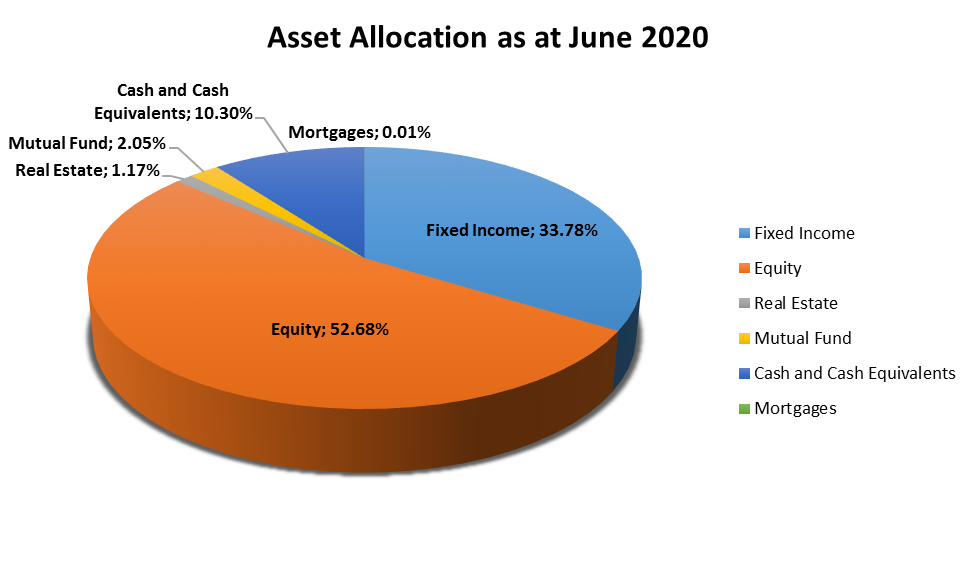

Portfolio Mix

The NIBTT continued to adopt a prudent and non-speculative approach to investments during FY2020. Equities accounted for the largest share of 52.68% of the investment portfolio based on market values at the end of FY 2020. This was followed by Fixed Income, Cash and Cash Equivalents.